North West Queensland has the potential to become a globally significant supplier of vanadium to the energy storage and steel markets.

Subscribe now for unlimited access.

$0/

(min cost $0)

or signup to continue reading

ASX-listed Intermin Resources Limited’s shares soared by a quarter after revealing an updated JORC resource for the Richmond Vanadium Project situated between Richmond and Julia Creek.

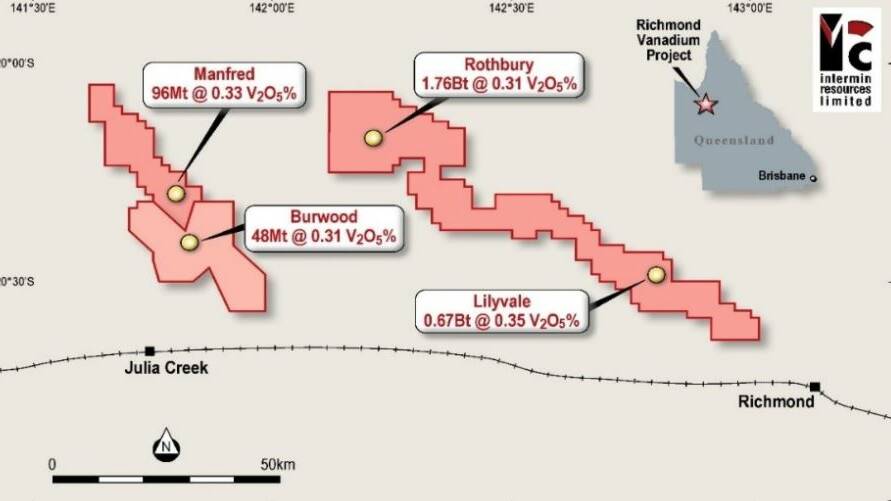

Interim own five exploration permits, north of Julia Creek and also north-west of Richmond and the global inferred resource for the permits totals 2.579 billion tonnes grading 0.32% vanadium pentoxide at a 0.29% cut-off grade, making it one of the largest vanadium deposits in the world.

China supplies over half the world’s vanadium and recent changes in Chinese policy include the banning of imported metal slag containing vanadium and stricter environmental regulations on Chinese steel mills has seen a dramatic decline in production while demand should to grow significantly in the next two decades from renewable energy storage systems and steel making.

The Richmond project is a joint venture with Chinese backed AXF Vanadium and AXF can earn up to a 75% interest by spending $6 million by 2021 with a feasibility study.

The project covers 1520 square kilometres and is close to existing infrastructure including a gas pipeline, the Flinders Hwy and the Mount Isa-Townsville railway linked to Townsville Port.

Intermin Resources managing director Jon Price said vanadium prices were reaching 10-year highs on the back of tightening supply and surging demand in the grid-scale battery market while the Richmond Project hosted a globally significant resource amenable to low cost, shallow open cut mining near existing road, rail and ports.

“Richmond has the potential to become a major supplier of Vanadium to the energy storage and steel markets” Mr Price said.

“The Company looks forward to supporting AXF as the JV completes infill drilling and metallurgical test work to assess the most economic and efficient pathway to commercial production.”

The resource remains open in all directions and is amenable to low cost, open cut mining with the resource located within 15 metres of surface and hosted in a soft marine sediment

Intermin’s initial development focus is on the shallow higher grade Lilyvale deposit which has a 671 million tonne resource grading 0.35% vanadium pentoxide.

Vanadium redox flow batteries are being increasingly used by the energy storage industry as a key component in the grid scale storage of solar and wind energy.

Currently, over half of the world’s vanadium production comes from China whether mined or as a by-product of steel making.

Recent changes in Chinese policy include the banning of imported metal slag containing vanadium and stricter environmental regulations on Chinese steel mills has seen a dramatic decline in production.

On the back of tightening supply and increased demand, vanadium prices have recently reached eight-year record highs.

With the release of the global resource, Intermin will now focus on the shallow higher grade Lilyvale prospect with work to include initial metallurgical test work on ore pre-treatment (due June quarter 2018) and infill drilling for a measured resource.